Instruments to trade:

Intraday or Positional:

Order Type:

Entry Conditions:

Buy-side:

Sell-side:

Target and SL and trailing:

Order Type Selection for Stoploss (SL-M or SL):

SL-M Order:

When you use SL-M order, it always gets filled. But there are chances of slippages.

SL order:

When you use SL order stop loss, the slippage will be limited based on the limit price of order stop loss. But there are chances that it may not get filled due to illiquidity. We have given the following mechanism to handle this:

SL price = 100

SL order buffer % = 10%

Modify Seconds = 10

Entry Type= Sell

With the above parameters, your trigger price for SL order will be 100, limit price will be 110. So when the price reaches 100, your SL order may get filled anywhere between 100 to 110. If there are no sellers available in this range, then your order will be converted into a limit order. After 10 seconds, if the order is open, it will modify it to market.

You can tweak the above parameters as per your requirement to get the best results.

If the broker’s API fails due to any reason while modifying the SL order to market after X seconds, then your position will be open without any SL. In this type of scenario, you will need to manage and exit manually. If you’re reluctant to use an SL order due to this, then you can use an SL-M order.

Trailing Logic:

Example 1: Equal distance trailing

For trailing, if LTP = 100, Initial SL % = 10% Trail % = 5%, and Trail by % = 5%, then it will trail like following:

Example 2: Unequal distance trailing

For trailing, if LTP = 100, Initial SL % = 10% Trail % = 5%, and Trail by % = 3%, then it will trail like following:

Common Buy-Sell Conditions Flags:

Adding Symbols:

For single contract selection:

For Multiple contract selection:

If No of the OTM contracts mentioned is 2, then it will add two OTM contracts from the ATM. Similarly, for ITM contracts.

Exit Conditions:

Quantity Logic:

Special Notes:

Global Configurable Parameters:

(These parameters are common for all the symbols/underlying added for the strategy.)

1. Start Time

2. Stop Order Placement Time

3. Exit Time

4. Timeframe

5. Max Profit

6. Max Loss

7. Place Orders

Configurable Parameters at symbol level:

(These parameters can be configured at symbol/stock/options level.)

1. No of lots

2. Entry Direction

3. SL % / SL Points

4. Target % / Target Points

5. Trail % / Trail Points

6. Trail by % / Trail by Points

7. Max Price

8. Min Price

9. Volume SMA Period

10. Volume Multiplier

11. RSI Period

12. RSI Overbought

13. RSI oversold

14. OI SMA Period

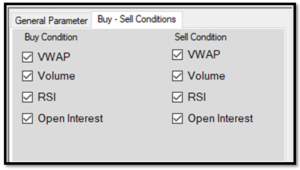

15. Buy Condition flags:

a. VWAP

b. Volume

c. RSI

d. Open Interest

16. Sell Condition flags:

a. VWAP

b. Volume

c. RSI

d. Open Interest

Screens:

Some Other Functionalities:

Supported Broker:

Infrastructure :