Algo Trading Strategies Development

Custom Algo Trading Strategy Development

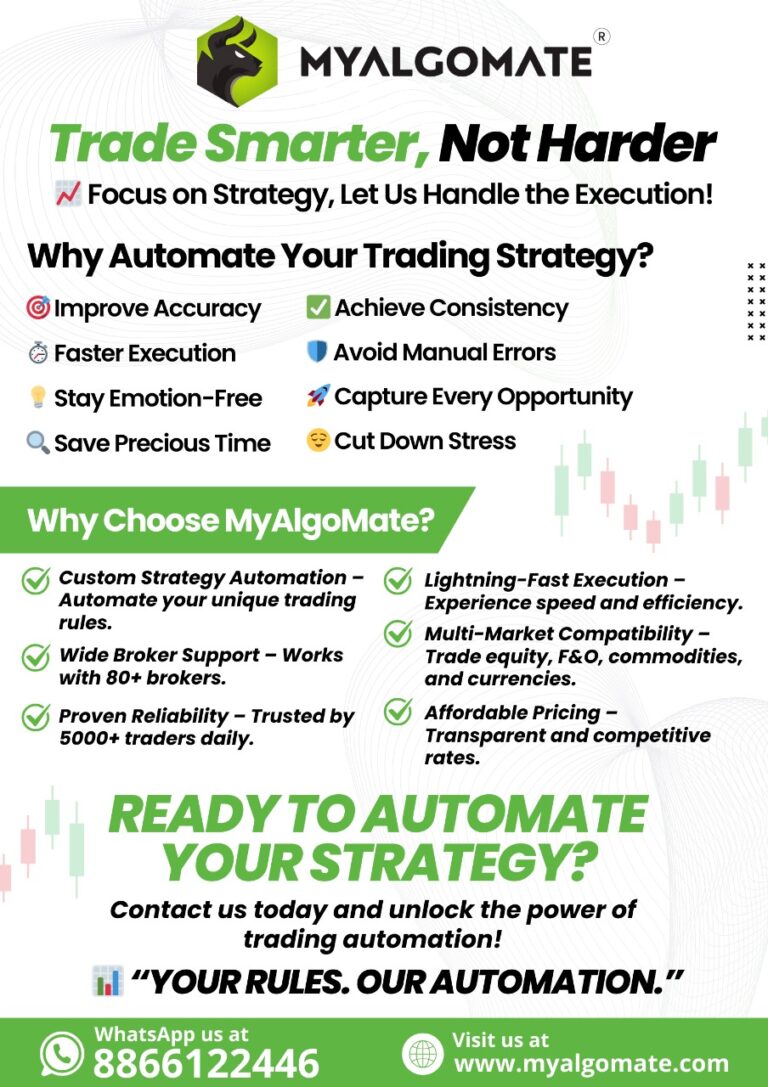

At Myalgomate, our Algo Trading Strategy development service is designed to transform your complex trading strategy rules into fully automated trading bots.

Our algo experts specialize in Trading Strategy Automation to cater to your specific trading requirements. We provide well-tested, high-performance auto trading bots tailored to your unique stock market strategy, ensuring a seamless, automated trading experience.

Whether you need a customized stock market strategy automation or an entirely new algo trading solution, Myalgomate’s expert developers are here to help you achieve your trading goals.

Transform your trading strategies with cutting-edge algo trading software.

Let Myalgomate be your partner in achieving market precision through strategy automation and custom solutions.

Start Your Journey with Myalgomate Today!

Experience hassle-free algo trading with our expert solutions. Submit your trading strategy requirements, and our team will simplify, automate, and backtest them for success.

Contact Us Now

Ready to automate your trading strategy?

Please submit the form and let’s start building your custom algo solution!

https://www.myalgomate.com/trading-software-developer/

Before submitting, check out our “FAQs” to answer common queries.

WhatsApp for any doubts/queries: https://wa.link/9ilrx0

Start Custom Algo Trading with Myalgomate now!

Algo Trading With Any Exchange & 80+ Brokers

Options Algo Trading Strategies Customization

We understand Your Options Algo Trading Needs. Unlock the full potential of Options Trading with our expertly crafted custom options Algo Trading Strategies, tailored to meet your unique needs.

Mathematical Model-Based

Strategies entail formulating precise mathematical equations and statistical models to predict market movements and make informed trading decisions.

Delta Neutral Options

Dynamically adjust a portfolio to maintain a delta-neutral position, mitigating directional risk & benefit from changes in implied volatility & time decay.

Mean Reversion or Trading Range

Identify price deviations from historical averages and execute trades to capitalize on the expected return to the mean within a defined price range.

Volume Weighted Average Price

VWAP strategy calculates the average daily trading price for precise order placement, minimizing market impact and slippage.

Time Weighted Average Price(TWAP)

The strategy that evenly spreads order executions over a specified time period to minimize market impact and achieve an average price for an asset.

Automate Algo Trading with Myalgomate now!

Custom Algo Trading Strategy Development We Offer

At Myalgomate, our custom Algo development services significantly enhance traders' performance and automate trading strategies in the financial market. We use advanced technologies to deliver innovative Custom Algorithm Trading solutions.

Paper Trading Simulation

Simulate and refine automated trading strategies using historical data, ensuring risk assessment and optimized code before live deployment.

Algo Trading Strategy development

Automated trading for better performance and efficiency, achieved by analyzing historical data, refining algorithms, and adapting to market changes.

Live Trading Automation

Execute predefined custom strategies in real-time, improving decision-making, reducing errors, and enhancing efficiency.

Exclusive Testing on Historical Data

Validate strategies using historical data testing to ensure reliability and effectiveness before live market deployment.

Advanced Backtesting Report

Analyze performance metrics, risk assessment, and profit/loss indicators to refine strategies for optimal results.

Strategy Automation

Our experts provide tailored algo solution tp automate your Trading strategy .

Algo Strategy automation with Myalgomate now!

Interested in learning more about our services?

Fill up the link form to start your journey with custom algo trading strategies development!Start Custom Algo Trading with Myalgomate now!

FAQ for Myalgomate Algo Trading Strategy Automation

Explore more about Myalgomate and unlock the future of automated trading!

Digital Marketing

Custom algo trading involves creating automated strategies tailored to individual trading needs, enabling faster and more efficient trade execution.

Myalgomate specializes in creating highly customized, efficient, and cost-effective algo trading solutions designed to meet your specific requirements.

No, our team handles all technical aspects. You simply provide your requirements, and we deliver a ready-to-use solution.

Development time varies depending on the complexity of the strategy, but most algos are completed within 2–4 weeks.

Our algos are compatible with popular platforms like Zerodha, Upstox, Angel One, and others. More Brokers List mentioned below: https://www.myalgomate.com/top-brokers/

We implement industry-grade encryption and security protocols to ensure your data and credentials remain safe.

The cost depends on the complexity of the strategy. Contact us for a personalized quote.

Yes, algo trading is legal and regulated in India under SEBI guidelines.

Yes, we specialize in creating custom strategies tailored to your exact specifications.

Leaders in Strategy Automation for increased efficiency and accuracy.

Why Choose Myalgomate for Algo Trading Strategy Automation ?

- Nikhil Sharma -

Portfolio Manager"Myalgomate's strategy automation has truly revolutionized my portfolio management. Their algo strategy development team crafted a solution tailored perfectly to my trading goals, enabling faster and more efficient executions. With Myalgomate, I’ve seen a noticeable improvement in my returns. Highly recommend them to anyone looking for the best algo developers!"

- Priya Mehta -

Independent Trader"I was looking for a reliable algo strategy developer, and Myalgomate exceeded my expectations. Their team delivered a strategy that optimized my trading process, minimizing risk and increasing profitability. The support and expertise they provide are unmatched. They are, without a doubt, the best in strategy automation."

- Rajiv Menon -

Hedge Fund Manager"Working with Myalgomate on strategy automation has been a game-changer. Their algo strategy development was customized to fit our fund's needs and has significantly improved our performance. If you’re seeking top-tier algo developers, Myalgomate should be your first choice. Their solutions are precise and dependable."

- Sneha Kapoor -

Financial Analyst"Myalgomate’s expertise in algo strategy development has transformed how I approach the market. Their ability to automate strategies tailored to my analysis has saved me time and maximized my potential profits. They are without a doubt the best when it comes to strategy automation and algo development."

- Arjun Desai -

Prop Trader"The algo strategy developed by Myalgomate has given me a significant edge in the market. Their team was able to integrate automation into my trading style, improving consistency and execution. If you're looking for the best algo developers in the business, Myalgomate is the perfect choice for efficient and cutting-edge strategy development."