Options Trading Strategies? Sounds difficult? Already worried? Well, don’t worry! We’ll help you break this down easily.

Here, we will discuss the Options Straddle Strategy (Short Straddle vs Long Straddle) in detail.

Options Trading Strategies

Option trading strategies use simple, “one-legged” orders to complex “multi-legged” orders. But simple or complex, what all strategies have in common is that they are based on two fundamental option types: CALL and PUT.

Straddle

Straddle is an options strategy where you can buy (or sell) a CALL and PUT with the same strike price and expiration date.

Let us understand these strategies one by one.

-

-

Short Straddle (Sell Straddle or Naked Straddle)

-

Long Straddle (Buy Straddle)

-

Also, check the Options Strangle Strategy (Short Strangle vs Long Strangle)

The automated version of this strategy is readily available at Myalgomate Marketplace as Time Based Options Straddle/Options Strangle.

Short Straddle (Sell Straddle or Naked Straddle) Options Straddle Strategy

| Strategy Level | Advance |

| Instruments Traded | Call + Put |

| Number of Positions | 2 |

| Market View | Neutral |

| Risk Profile | Unlimited |

| Reward Profile | Limited |

| Breakeven Point | 2 Breakeven Points |

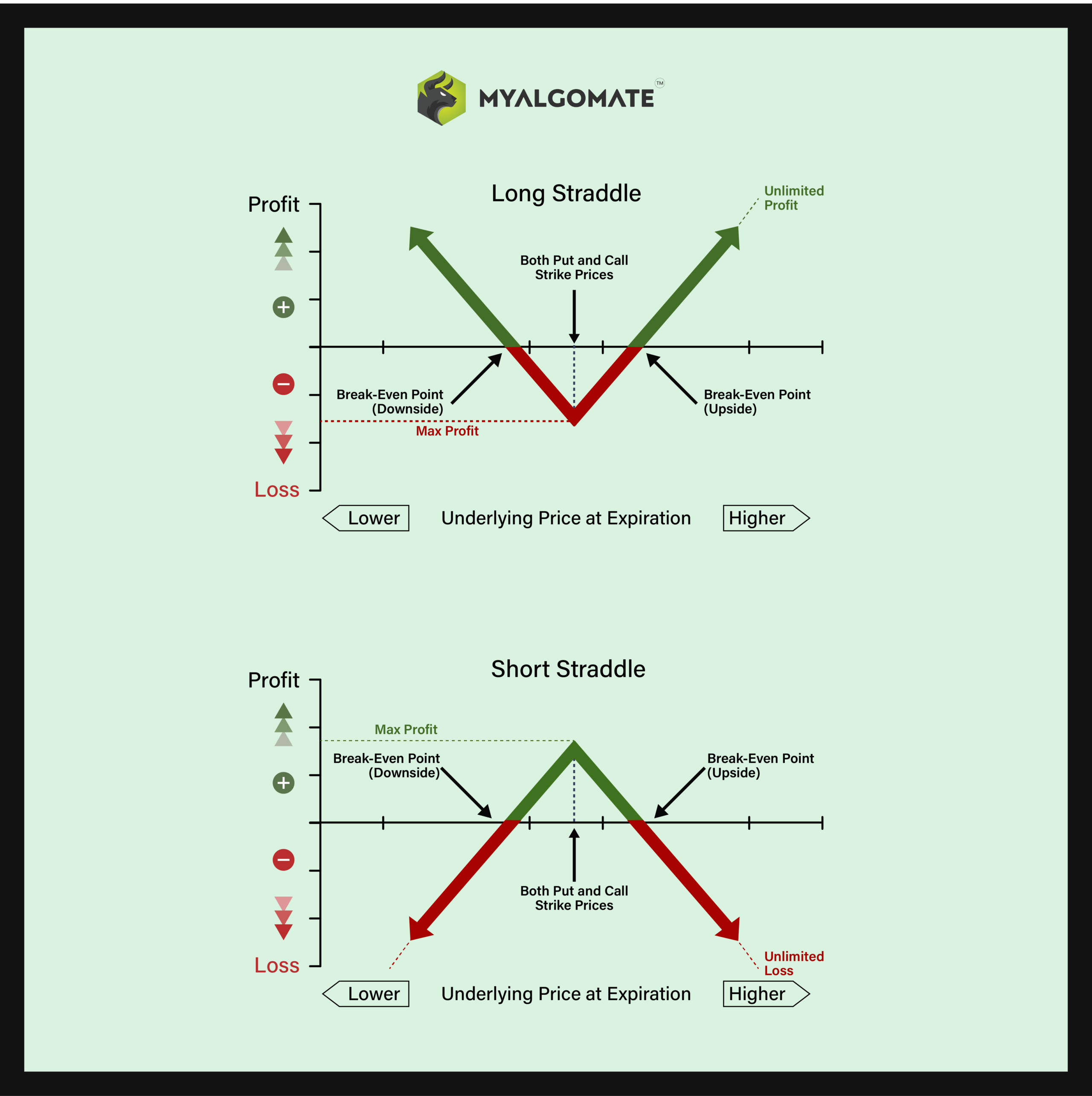

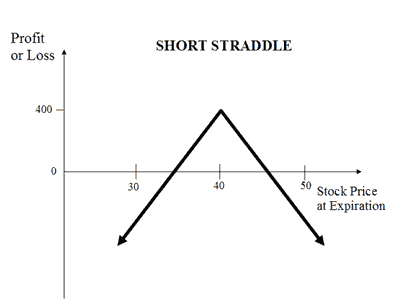

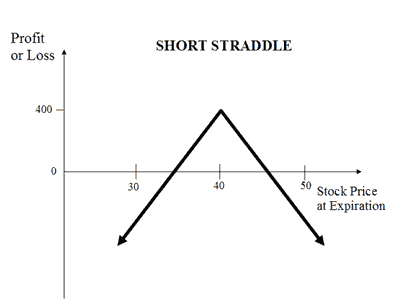

The Short Straddle (or Sell Straddle or naked Straddle) is a neutral options strategy. This strategy involves simultaneously selling a call and a put option of the same underlying asset, same strike price, and same expiry date.

A Short Straddle strategy is used in case of little volatility market scenarios wherein you expect none or very little movement in the price of the underlying. Such scenarios arise when there is no major news expected until expires.

This is a limited profit and unlimited loss strategy. The maximum profit is earned when, on the expiry date, the underlying asset is trading at the strike price at which the options are sold. The maximum loss is unlimited and occurs when the underlying asset price moves sharply in an upward or downward direction on the day of expiring.

The usual Short Straddle Strategy looks like as below for NIFTY current index value at 18000(NIFTY Spot Price):

| Orders | NIFTY Strike Price |

|---|---|

| Sell 1 Put Option | NIFTY18APR18000PE |

| Sell 1 Call Option | NIFTY18APR18000CE |

Suppose NIFTY is currently trading at 18000. You don’t expect much movement in its price in near future. The Short Straddle strategy can be implemented by selling 18000 NIFTY Put and 18000 NIFTY Call. The net premium received by selling Put and Call Options will be your maximum profit while the losses can be unlimited if the price moves sharply in either direction.

What about Theta (Time) Decay?

Theta decay for short straddles is one of the only ways the trade produces a profit, besides volatility contraction. Premium is priced out of ATM options faster than ITM options, so short straddles greatly benefit from time decay. Both legs of the trade, the short call, and the short put, are beneficial to theta decay.

Important Tips for Straddle Selling

Traders should use additional caution when trading short straddles, as it is an undefined risk trade. Although the trade will be delta-neutral open order-entry, large moves in either direction in the underlying can cause significant losses.

In addition, large volatility increases can cause significant losses as well. The most important thing to remember when trading short straddles is that dramatic movements either up or down will significantly harm the position. This is why selling straddles is a common tactic for large low-beta indices that don’t move as much as individual stocks

Long Straddle (Buy Straddle) Options Straddle Strategy

| Strategy Level | Beginners |

| Instruments Traded | Call + Put |

| Number of Positions | 2 |

| Market View | Neutral |

| Risk Profile | Limited |

| Reward Profile | Unlimited |

| Breakeven Point | 2 Breakeven Points |

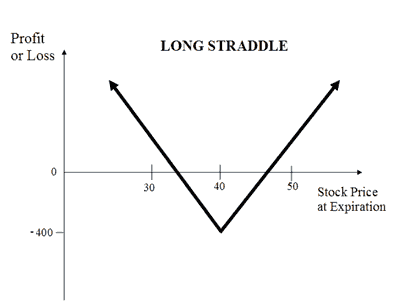

The Long Straddle (or Buy Straddle) is a neutral strategy. This strategy involves simultaneously buying a call and a put option of the same underlying asset, same strike price, and same expiry date.

A Long Straddle strategy is used in the case of highly volatile market scenarios wherein you expect a big movement in the price of the underlying but are not sure of the direction. Such scenarios arise when a company declares results, budget, war-like situation, etc.

This is an unlimited profit and limited risk strategy. The profit earns in this strategy is unlimited. Higher volatility results in higher profits. The maximum loss is limited to the net premium paid. The max loss occurs when the underlying asset price on expire remains at the strike price.

The usual Long Straddle Strategy looks like as below for NIFTY current index value at 18000 (NIFTY Spot Price):

| Orders | NIFTY Strike Price |

|---|---|

| But 1 Put Option | NIFTY18APR18000PE |

| Buy 1 Call Option | NIFTY18APR18000CE |

Suppose Nifty is currently at 18000 and due to some upcoming events you expect the price to move sharply but are unsure about the direction. In such a scenario, you can execute a long strangle strategy by buying Nifty Put at 18000 and buying Nifty Call at 18000. The net premium paid will be your maximum loss while the profit will depend on how high or low the index moves.

What about Theta (Time) Decay?

Theta decay for a long straddle is not beneficial at all. If the underlying asset (like a stock, futures contract, index, etc.) doesn’t move at all before expiration, long straddles will lose money because of premium decay. This means timing is very important. If the underlying asset moves after expiration, it won’t do any good.

Important Tips for Straddle Buying

On the surface, long straddles seem like the perfect options trading strategy. Who knows if a stock is going to move up or down? Chances are, it’s going to move one way or the other…unless it doesn’t. The only way the long straddle options strategy will not be profitable is if nothing happens prior to expiration, or if volatility collapses.

Therefore, long straddles are very interesting trades for volatile markets with large price swings.

Comparison: Long Straddle (Buy Straddle) Vs Short Straddle (Sell Straddle or Naked Straddle)

| Long Straddle (Buy Straddle) | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

|

|

|

| About Strategy | The Long Straddle (or Buy Straddle) is a neutral strategy. This strategy involves simultaneously buying a call and a put option of the same underlying asset, same strike price, and same expiry date. A Long Straddle strategy is used in the case of highly volatile market scenarios wherein you expect a big movement in the price of the underlying but are not sure of the direction. Such scenarios arise when a company declares results, budget, war-like situation, etc. | The Short Straddle (or Sell Straddle or naked Straddle) is a neutral options strategy. This strategy involves simultaneously selling a call and a put option of the same underlying asset, same strike price, and same expiry date. A Short Straddle strategy is used in case of little volatility market scenarios wherein you expect none or very little movement in the price of the underlying. Such scenarios arise when there is no major news expected until expires. |

| Market View | Neutral | Neutral |

| Strategy Level | Beginners | Advance |

| Options Type | Call + Put | Call + Put |

| Number of Positions | 2 | 2 |

| Risk Profile | Limited | Unlimited |

| Reward Profile | Unlimited | Limited |

| Breakeven Point | 2 Breakeven points | 2 Breakeven points |

When and how to use Long Straddle (Buy Straddle) and Short Straddle (Sell Straddle or Naked Straddle)?

| Long Straddle (Buy Straddle) | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

| When to use it? | The strategy is perfect to use when there is market volatility expected due to results, elections, budget, policy change, war, etc. | This strategy is to be used when you expect a flat market in the coming days with very little movement in the prices of the underlying assets. |

| Market View | Neutral

When you are not sure on the direction the underlying would move but are expecting the rise in its volatility. |

Neutral

When a trader doesn’t expect much movement in its price in near future. |

| Action |

|

|

| Breakeven Point | 2 break-even points

A straddle has two break-even points. Lower Breakeven = Strike Price of Put – Net Premium Upper breakeven = Strike Price of Call + Net Premium |

2 Breakeven Points

There are 2 break-even points in this strategy. The upper break even is hit when the underlying price is equal to the total strike price of short call and net premium paid. The lower break-even is hit when the underlying price is equal to the difference between the strike price of short Put and the net premium paid. Break-even points: Lower Breakeven = Strike Price of Put – Net Premium Upper breakeven = Strike Price of Call+ Net Premium |

Compare Risks and Rewards (Long Straddle (Buy Straddle) Vs Short Straddle (Sell Straddle or Naked Straddle))

| Long Straddle (Buy Straddle) | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

| Risks | Limited

The maximum loss for the long straddle strategy is limited to the net premium paid. It happens the price of underlying is equal to the strike price of options. Maximum Loss = Net Premium Paid |

Unlimited

There is a possibility of unlimited loss in the short straddle strategy. The loss occurs when the price of the underlying significantly moves upwards and downwards. Loss = Price of Underlying – Strike Price of Short Call-Net Premium Received Or Loss= Strike Price of Short Put – Price of Underlying – Net Premium Received |

| Rewards | Unlimited

There is unlimited profit opportunity in this strategy irrespective of the direction of the underlying. Profit occurs when the price of the underlying is greater than the strike price of a long Put or lesser than the strike price of a long Call. |

Limited

Maximum profit is limited to the net premium received. The profit is achieved when the price of the underlying is equal to either the strike price of short Call or Put. |

| Maximum Profit Scenario | Max profit is achieved when one option is exercised. | Both Options not exercised |

| Maximum Loss Scenario | When both options are not exercised. This happens when the underlying asset price on expire remains at the strike price. | One Option exercised |

Pros & Cons of Long Straddle (Buy Straddle) and Short Straddle (Sell Straddle or Naked Straddle)

| Long Straddle (Buy Straddle) | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

| Advantages | Earns you unlimited profit in a volatile market while minimizing the loss. | It allows you to benefit from double time decay and earn profit in a less volatile scenario. |

| Disadvantage | The price change has to be bigger to make good profits. | Unlimited losses if the price of the underlying move significantly in either direction. |

| Similar Strategies | Long Strangle, Short Straddle | Short Strangle, Long Straddle |

What’s Next?

I hope you enjoyed reading about algorithmic trading strategies.

check out our next blog for Detailed information on Options Strangle Strategy (Short Strangle vs Long Strangle)

Disclaimer: All data and information provided in this article are for informational purposes only. Myalgomate™ makes no representations as to the accuracy, completeness, correctness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

6 Comments

Ashish

August 30, 2022I want to understand algo trade

What to do??

If possible plz call me after 11.00 am to 5.00 pm

9978985187

Ashish patel

Rishi Ajmera

September 5, 2022Hi ,

you can check our blogs to know more about algo trading.

1. What is Algorithmic Trading?

https://www.myalgomate.com/what-is-algorithmic-trading/

2.Why Algorithmic Trading should be done?

https://www.myalgomate.com/why-algorithmic-trading/

virendra

August 15, 2022very good for biginer…but ..r u provide trainning..

Rishi Ajmera

August 16, 2022Hi Virendra,

We don’t provide any training we are an Algo trading software development company.

We can help you automate your trades.

Regards,

Team Myalgomate.

Shraddha Cholera

November 13, 2021Worthy to read…👍👍

Options Strangle Strategy (Short Strangle Vs Long Strangle) - Myalgomate

November 11, 2021[…] Also, check Options Straddle Strategy (Short Straddle vs Long Straddle) […]